The Savvy Donor: Maximizing Your Charitable Donations

When planning to make a gift to a charity in a will, people often think of making a set cash donation. If the estate includes shares of a public company, making a non-cash donation to the organization is even more tax effective. By gifting public company shares to the charity, no tax is payable on the sale of the public company shares.

Public company shares generally refer to shares of a company that are listed on a designated stock exchange, in contrast to shares of a privately held company such as a small family-run business.

When one dies, most assets included in one’s estate, including public company shares, will be treated as if they were sold immediately prior to death at their fair market value (except for assets transferred to a spouse, which in most cases can be transferred on a tax-free basis). If the value of certain assets, such as investments, has increased since their initial purchase, a capital gain will be realized, half of which will be added to the deceased’s taxable income in their final tax return.

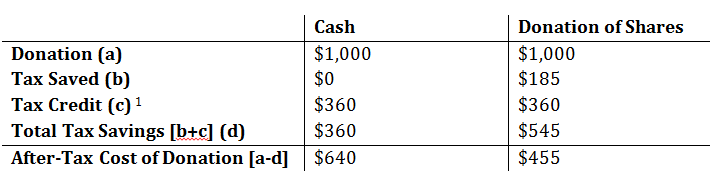

Suppose an individual wanted to make a donation to a charity in their will in the amount of $1,000 and they owned public company shares worth $1,000, which were purchased five years before for $200. If the individual decided to make the donation in the form of cash, leaving the public company shares in the estate, the shares would be treated as though they were sold at fair market value immediately prior to death, and tax would be payable on any capital gain realized immediately prior to the date of death. In this case, the capital gain would be $800 [$1,000 – $200], only half of which is taxable. If we assume a combined federal and provincial tax rate of 46%, the tax on the capital gain would be roughly $185 [46% x ($800/2)]. If instead of donating cash, the individual gifted the public company shares directly to the charity, there would be no tax payable on the capital gain for the deceased, resulting in tax savings of $185.

A donation of public company shares is a more tax efficient charitable gift:

It is important to note that certain other forms of securities (such as mutual funds) can share the same advantageous tax treatment as public company shares.

If you have questions or require further information, please contact us and we will put you in touch with a member of our Taxation team to discuss various estate planning options.